Today, the Federal Board of Revenue Islamabad – Revenue Division Government of Pakistan has announced new employment opportunities for Pakistanis. This announcement notice of the FBR Jobs 2022 Recruitment Notice | Fill NJP Online Apply Form can be downloaded from the Daily Express.

The FBR – Revenue Division is seeking applications from qualified, dynamic, and motivated individuals for the recruitment of various staff positions in The Regional Tax Offices.

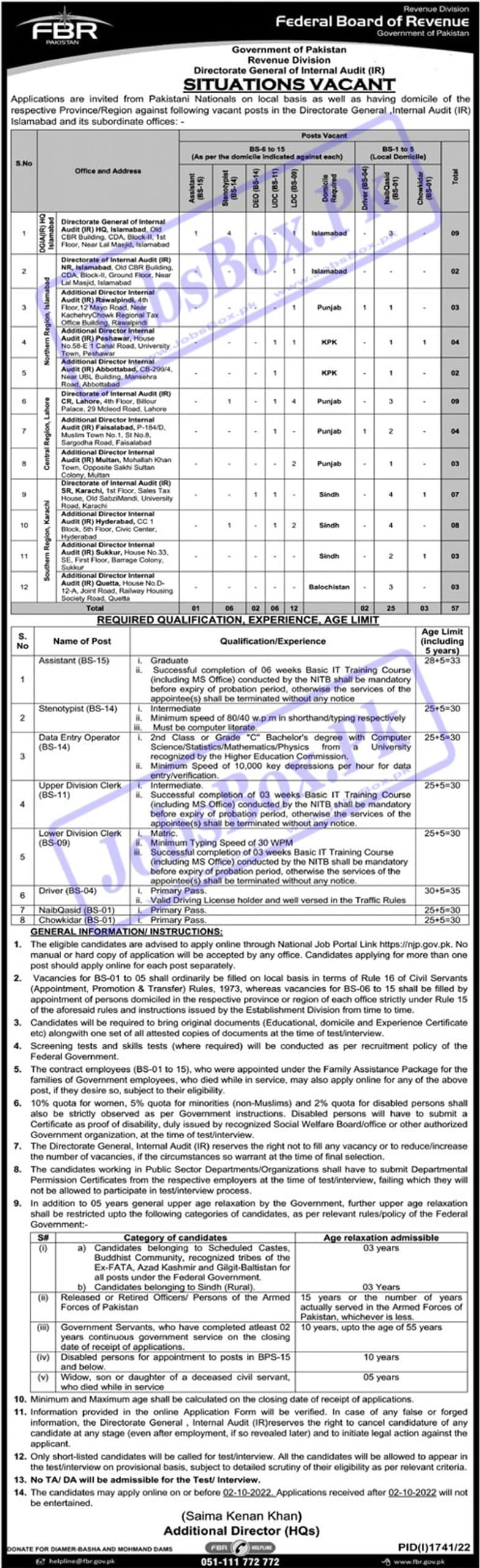

These vacancies are opening in the Regional Tax Office in Islamabad, Rawalpindi, Peshawar, Abbottabad, Lahore, Faisalabad, Multan, Karachi, Hyderabad, Sukkur, and Quetta.

Candidates who are living in Khyber Pakhtunkhwa, Punjab, Sindh, and Balochistan are eligible to apply. Only Eligible individuals who perfectly fill the eligibility terms and conditions can apply.

These Federal Government Jobs 2022 are opening for both Male/Female applicants who fill the eligibility terms and conditions. Quotas for Minorities & Disabled Persons shall be reserved as per Federal Government Rules.

Federal Board of Revenue - FBR Jobs Latest

| Posted on: | 22nd September 2022 |

| Location: | Pakistan |

| Education: | Primary, Middle, Matric, Intermediate, Bachelor |

| Last Date: | 02 November, 2022 |

| Vacancies: | 57 |

| Company: | Federal Board of Revenue - FBR |

| Address: | Director HR, Directorate General of DNFBPs, Federal Board of Revenue, Islamabad |

| Follow | WhatsApp Channel |

| Job Alerts: |

Vacant Positions:

Positions are opening of Assistants, Steno-typists, Data Entry Operators, Upper Division Clerks UDC, Lower Division Clerks LDC, Driver Naib Qasid, and Chowkidar.

To get employed in these positions applicants must hold qualifications (Primary, Middle, Matriculation, Intermediate, and Graduation). The age limitation is available in the advertisement.

Candidates belonging to scheduled castes Buddhist Community, Recognized Tribe of Ex-FATA/PATA, AK, and GB will be given 3 years more general age relaxation in the upper age limit.

Company Introduction:

FBR is the federal board of revenue. It works enforcement law agency for Pakistan that inquires about taxes and the crimes related to them, money laundering, black money, and other illegal money accumulations that are against the laws and regulations of the Pakistani government act.

Firstly, FBR was created on April 01, 1924, through the enactment of the central board revenue act 1924. In 1944, full-fledged division revenue.

FBR works for the enhancement of a system that provides us with a modern, progressive, effective, and credible organization for optimization of modern revenue for providing quality service and by promoting related laws and rules which can enhance the modern revenue system.

FBR performs the role of collecting taxes in the country from all individuals and businesses. FBR also collects intelligence on tax evasion and administers tax laws for the Government of Pakistan and acts as the central revenue collection department of Pakistan.

Domestic Taxes, Income Tax, Sales Tax, and Federal Excise Duty, constitute about 90% of the Revenue collected by FBR. These taxes are not only similar in essence but also interdependent in practice. The time-tested international tenor vindicates the same.

FBR promotes the capability of the tax system to collect due taxes through the application of modern techniques, providing taxpayer assistance, and creating a motivated, satisfied, dedicated, and professional workforce.

How to Apply Online?

- The FBR invites applications online through the National Job Portal NJP www.njp.gov.pk.

- You can open the NJP website and select “Employer Name” and search “Revenue Division“.

- After searching the Revenue Division, you will find all vacancies opening in the FBR.

- There you can apply for your desired post if you have already a Profile on NJP.

- If you don’t have a profile yet, you have to click on Sign Up and create a profile by providing the required information.

- Information provided in the Online Form will be verified by FBR.

- The Online Form on the NJP website will be available till 2nd October 2022.

FBR Jobs 2022 Recruitment Notice | Fill NJP Online Apply Form

I m intrested

I went this job

Jan. Interested in driver job please

Very need job

Naib qasad